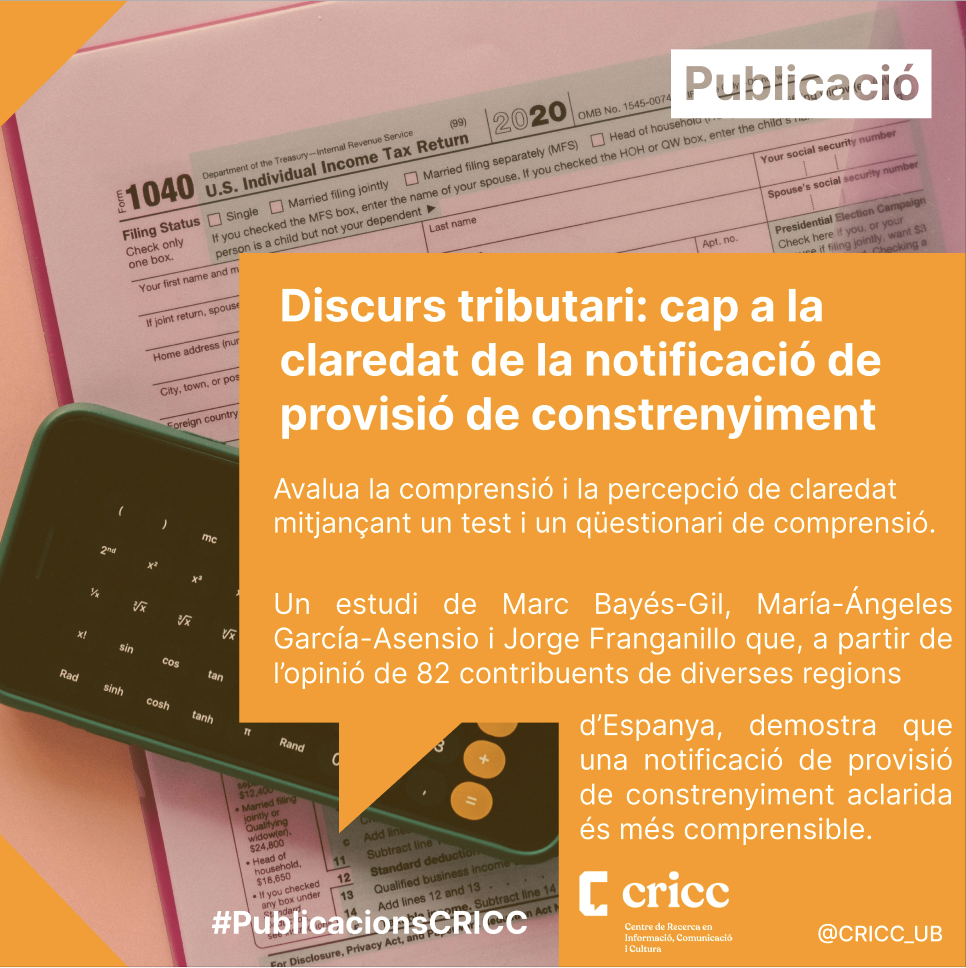

Paying taxes is an essential part of civic life, but what happens when the notices we receive are confusing? A new study published in Infonomy addresses this problem and looks at how to simplify and clarify the notification of ‘providencia de apremio’, the official notice of an outstanding debt owed to the public administration.

The study, entitled ‘Tax discourse: towards the clarity of the notice of enforcement order’ and prepared by Marc Bayés-Gil, M.ª Ángeles García-Asensio and Jorge Franganillo, presents the methodology and results of the evaluation of a clarified prototype of this document. After analysing through tests and questionnaires the experience of 82 taxpayers with the current version (used in more than 4,500 Spanish municipalities) and with the new version, the research concludes that the clarified version is significantly more comprehensible.

This improvement has been achieved with the work of an interdisciplinary team of specialists in communication and clear language, made up of two tax lawyers, four linguists, three graphic designers and two professionals from the Customer Service and Communication areas of the company Gestión Tributaria Territorial (GTT).

The new version simplifies sentences, explains legal jargon, reorganises information and improves the layout. While the results show a significant improvement in clarity, the study has also identified areas for improvement, such as information on deferrals and instalments. These findings will guide the final optimisation of the document.

This research highlights the importance of collaboration between disciplines to achieve clearer administrative documents, reaffirms the commitment of public administrations to transparency and plain language, offers a model for improving communication between administrations and citizens, and opens the door to future research on tax discourse.

Bayés-Gil, M., García-Asensio, M.- Ángeles, & Franganillo, J. (2025). Discurso tributario: hacia la claridad de la notificación de providencia de apremio . Infonomy, 3(1). https://doi.org/10.3145/infonomy.25.005